The State of AI 2025–2026: Part I - The Triennium

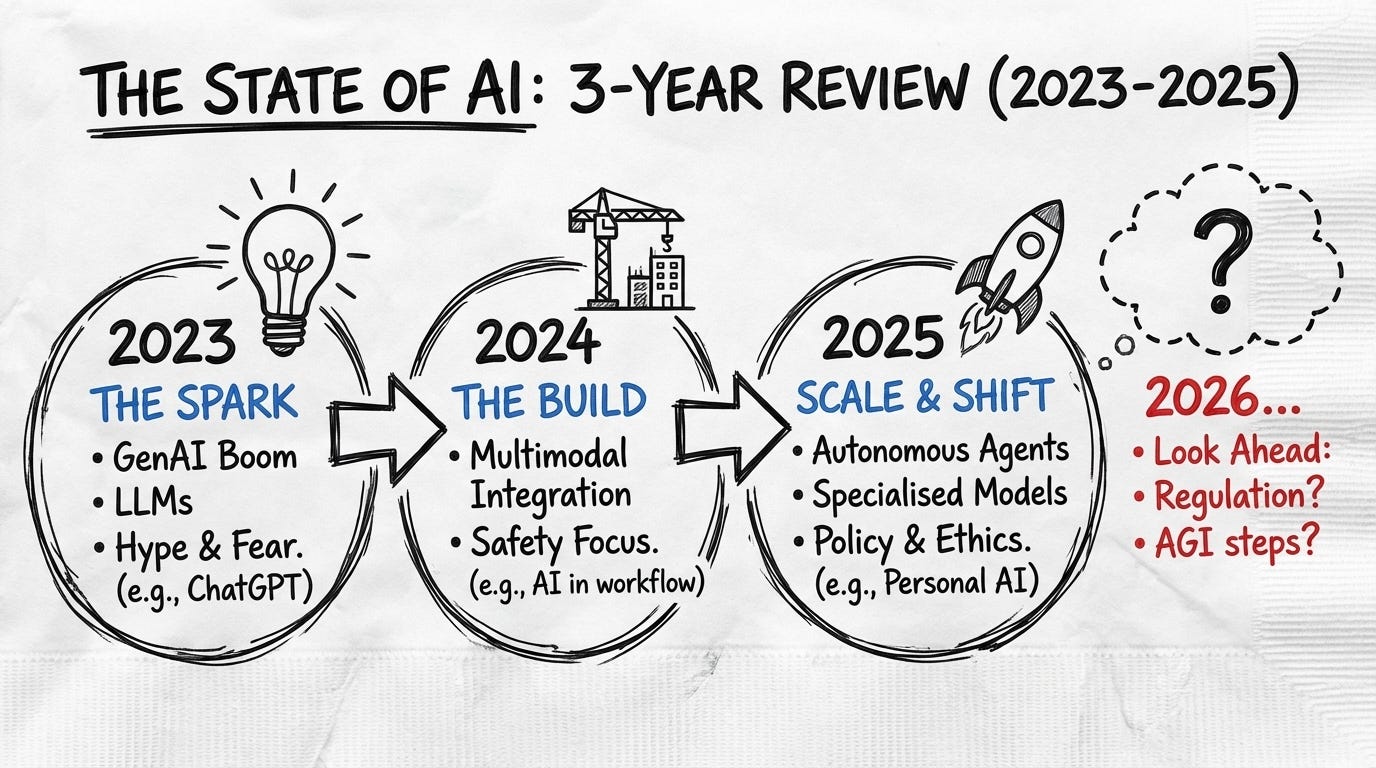

The three-year period of 2023–2025 will be recorded in industrial history not merely as a period of technological innovation, but as a fundamental reshaping of the corporate operating model

The Transition to the Autonomous Enterprise

The three-year period of 2023–2025 will be recorded in industrial history not merely as a period of technological innovation, but as a fundamental reshaping of the corporate operating model. We have witnessed the path of Artificial Intelligence evolve from an experimental tool into a reliable business system capable of reasoning, planning, and acting. The “State of AI” as we enter 2026 is no longer defined by model parameters or benchmark scores, but by integrated independence.

The shift to 2026 will be characterised by three fundamental shifts that define the “Agentic Enterprise.”

First, the transition from Chat to Action, where AI moves from finding information (RAG) to executing complex business processes (Tool use and Agentic workflows).

Second, the shift from Global to National, driven by the rise of Sovereign AI initiatives in Japan, the UK, China, and France, making data location a critical component of geopolitical strategy.

Third, the bridge from Digital to Physical, led by the initial commercial deployment of humanoid robotics in logistics, closing the loop between digital reasoning and physical labour.

In this three-part article I will cover the following:

Part I: The Three-Year Review (2023–2025) - This article

Part II: The Frontier of Capability (2025 Benchmark)

Part I: The Three-Year Review (2023–2025)

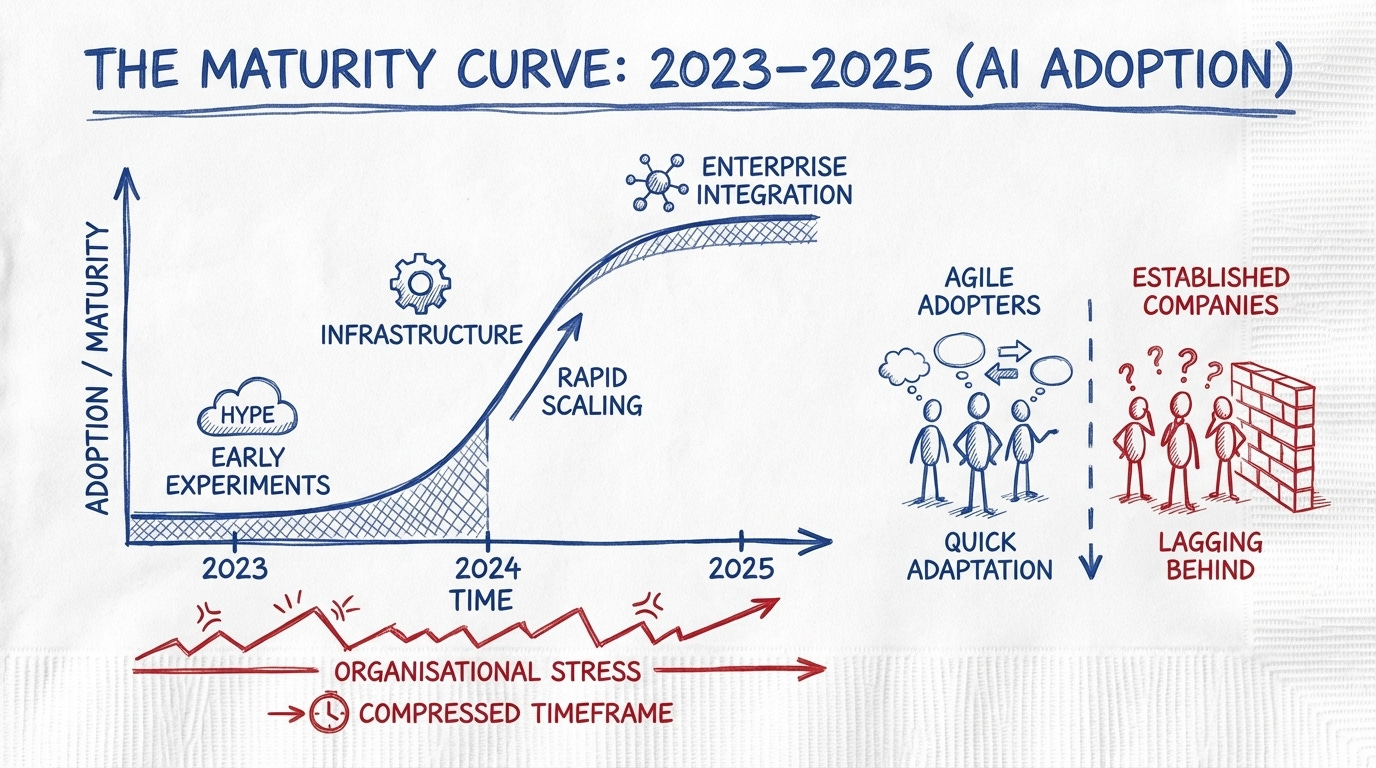

The Maturity Curve: From Hype to Infrastructure

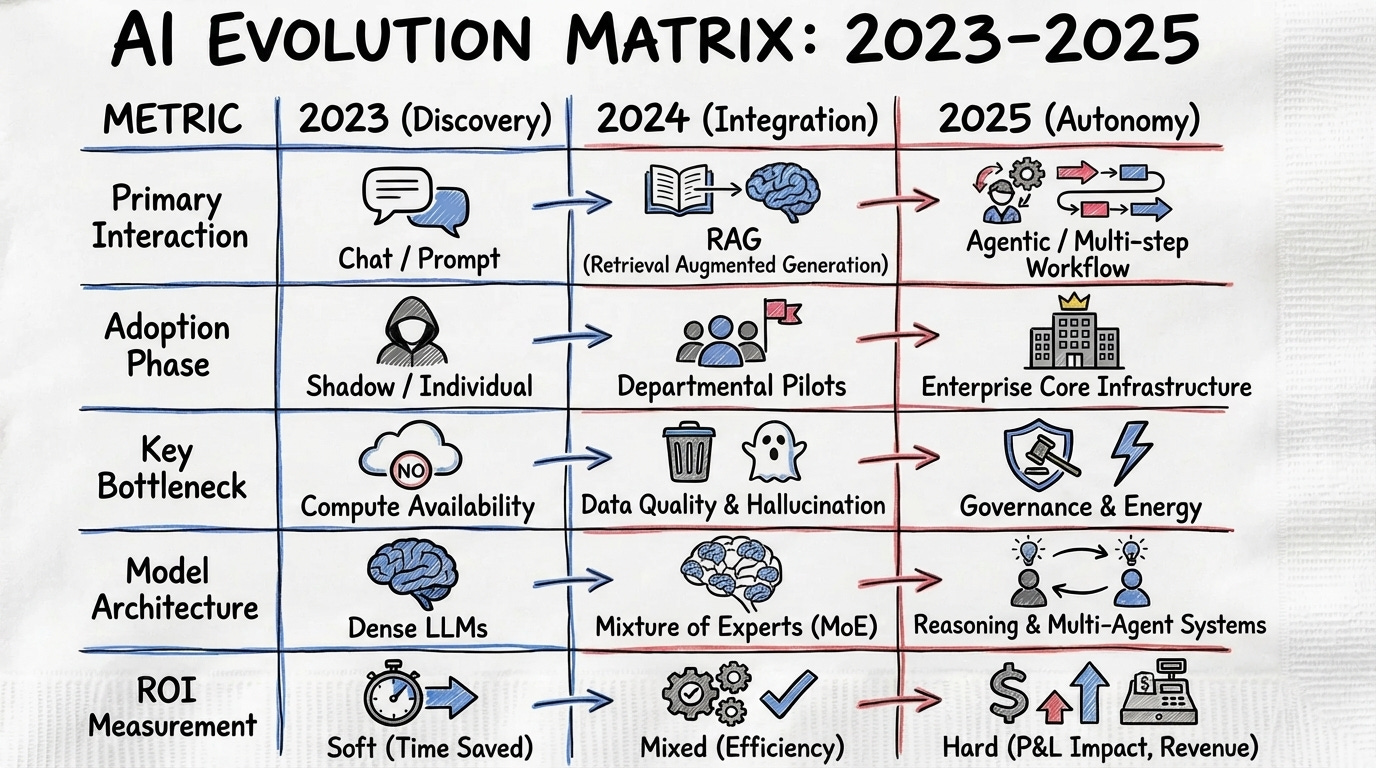

The adoption path from 2023 to 2025 traces a classic S-curve, compressed into a timeframe previously considered impossible for enterprise technology. This compression has created significant organisational stress, separating agile adopters from established companies.

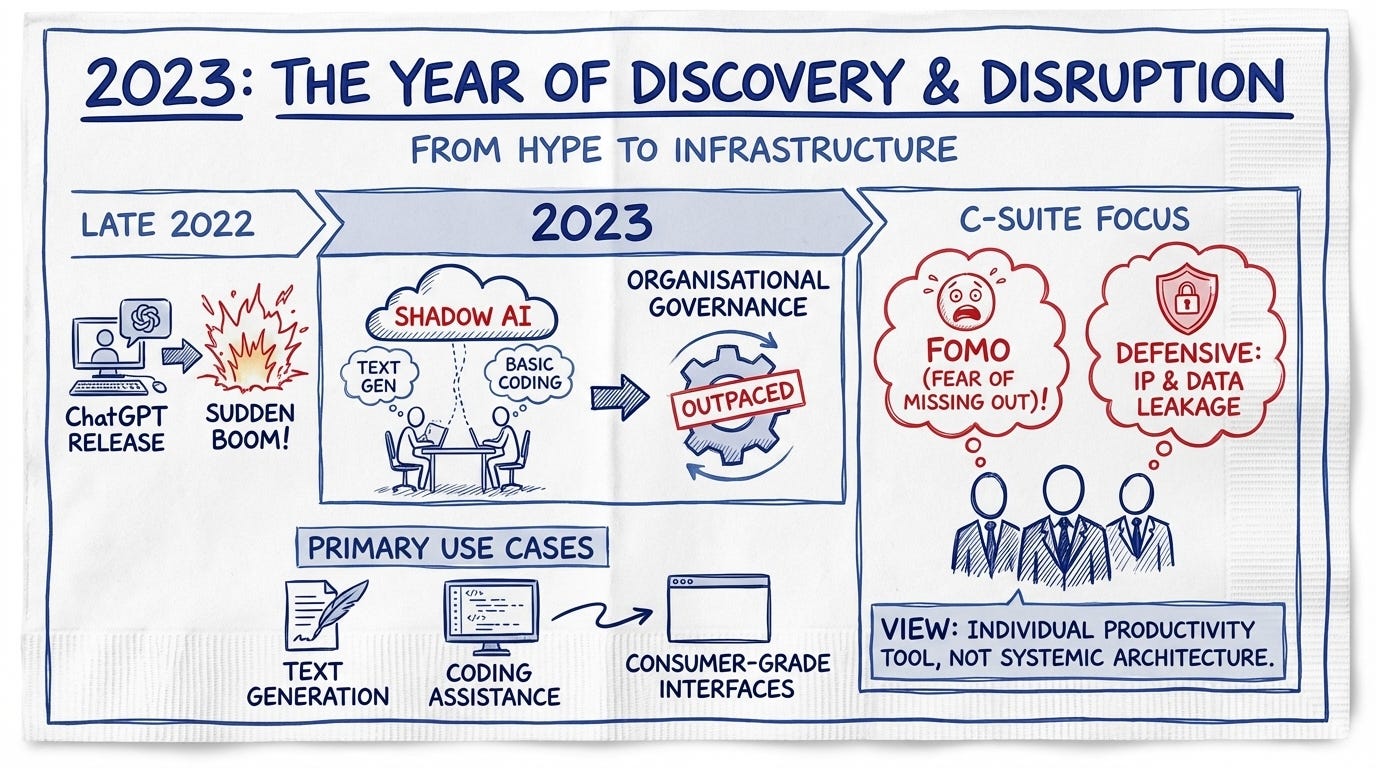

2023: The Year of Discovery and Disruption

The release of ChatGPT in late 2022 ignited a “sudden boom” of generative capability. 2023 was characterised by “Shadow AI“, where employee adoption outpaced organisational governance. The primary use cases were text generation and basic coding assistance, often deployed via consumer-grade interfaces.

The C-Suite focus was exploratory, driven by FOMO (Fear Of Missing Out) and defensive measures regarding intellectual property and data leakage. At this stage, AI was largely viewed as a productivity tool for individual workers rather than a systemic architectural component.

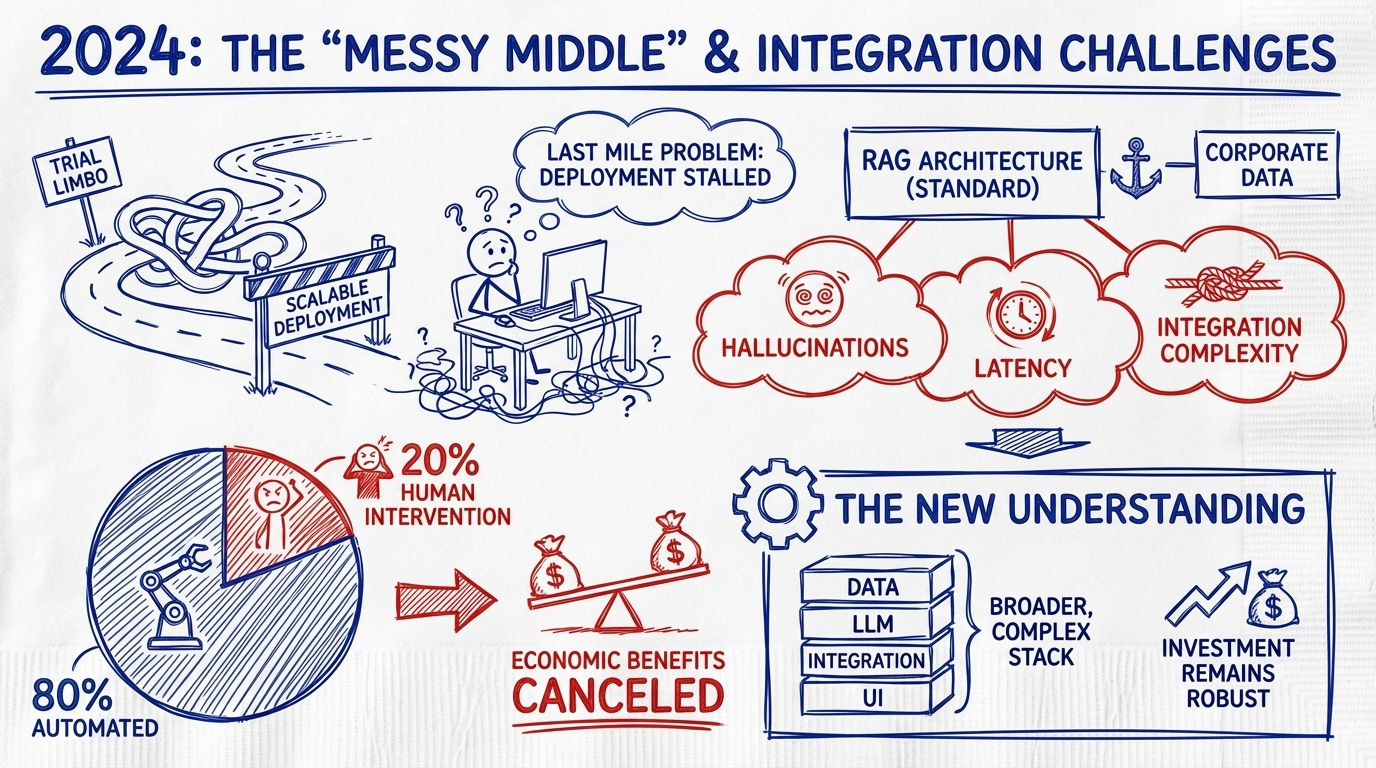

2024: The “Messy Middle” and Integration Challenges

2024 marked the “trial limbo“ phase. Organisations struggled with the “last mile” problem of deployment. While Retrieval-Augmented Generation (RAG) became the standard architecture for anchoring models in corporate data, persistent issues with hallucinations, latency, and integration complexity prevented scalable deployment. Many businesses found that while 80% of a workflow could be automated, the remaining 20% required human intervention that canceled out the economic benefits. However, investment remained robust as the market began to understand that Large Language Models (LLMs) were not standalone products but components of a broader, more complex stack.

2025: The Year of Production and Agency

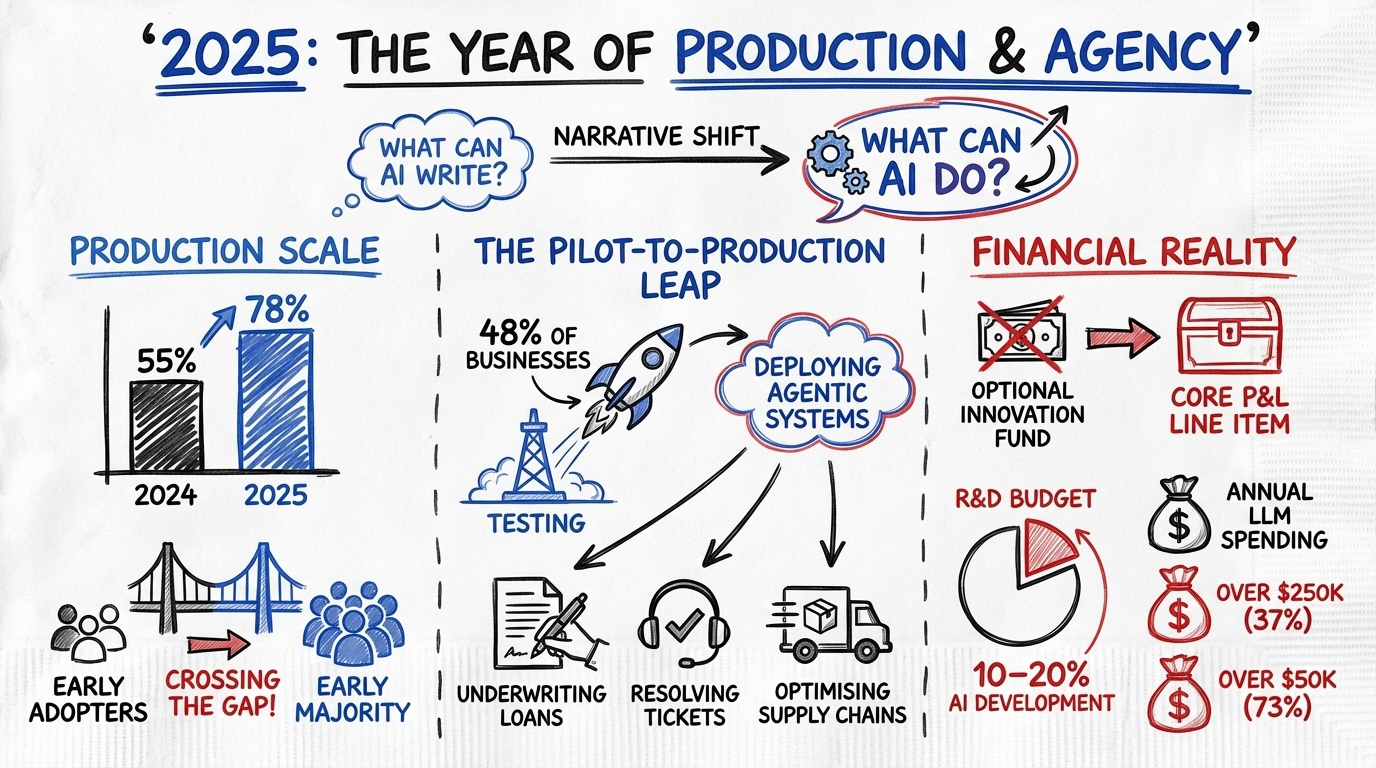

2025 defined the turning point where “potential” converted into “production.” The narrative shifted decisively from “What can AI write?” to “What can AI do?”

Production Scale: By late 2025, 78% of organisations reported using AI in at least one business function, a dramatic rise from 55% the previous year. This indicates that AI has crossed the gap from early adopters to the early majority.

The Pilot-to-Production Leap: 48% of businesses moved beyond testing to deploying Agentic systems in production environments. These systems are not merely answering questions; they are underwriting loans, resolving customer service tickets, and optimising supply chains autonomously.

Financial Reality: AI budgets transitioned from optional “innovation funds” to core P&L line items. AI-enabled companies are now allocating 10–20% of their total R&D budgets to AI development. Spending patterns reveal serious commitment, with 37% of businesses now spending over $250,000 annually on LLMs, and 73% spending over $50,000.

Table 1: The Three-Year Maturity Matrix

The ROI Reality Check: The Valuation Gap

The “Productivity Paradox” feared by economists, that AI implementation would fail to show up in financial results, has largely been disproven by 2025 data. However, the distribution of value is highly uneven, creating a “Valuation Gap” between AI Leaders and Followers.

Organisations effectively leveraging AI are achieving a 3.7x average ROI on their investments, with top performers reaching an astounding 10.3x return through strategic, deep integration. This massive differential suggests that the value of AI is not linear but exponential based on the depth of process re-engineering.

Cost Structure Transformation

The most profound impact is visible in operational cost structures, particularly in customer support and service delivery. AI agents are dramatically altering the cost of each interaction. While human agent costs typically range from $3.00 to $6.00 per interaction, AI agents have driven this cost down to between $0.25 and $0.50. This represents a massive reduction in operating costs.

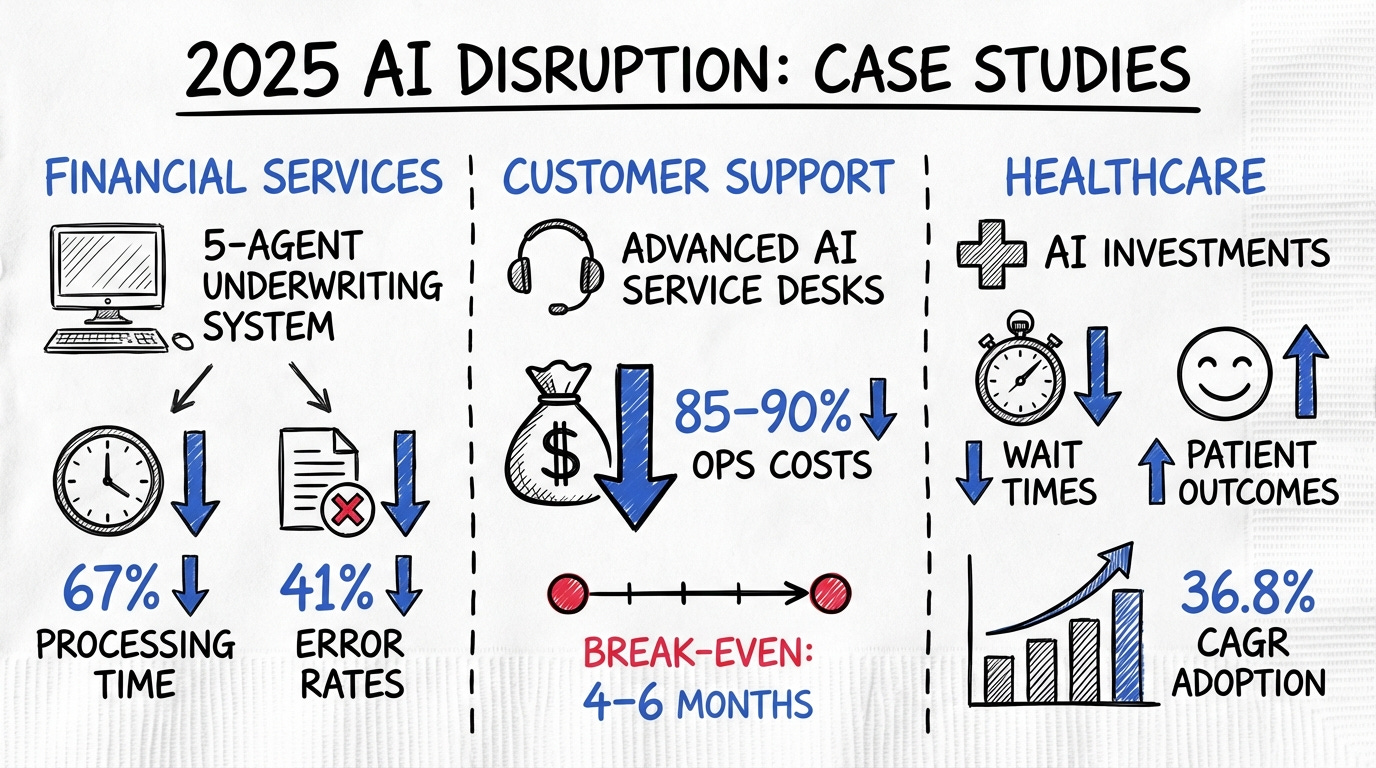

Case studies from 2025 illustrate the scale of this disruption:

Financial Services: A financial services client deployed a five-agent underwriting system that reduced processing time by 67% and error rates by 41%.

Customer Support: Organisations implementing advanced AI service desks report 85–90% cost reductions in operations, with the break-even point for AI implementation occurring within 4–6 months.

Healthcare: Hospitals have increased AI investments to reduce wait times and improve patient outcomes, with the sector showing a 36.8% compound annual growth rate in adoption.

Looking Ahead: The Capability Frontier

This retrospective establishes the trajectory of the last three years, but the velocity of future change will be determined by underlying model capabilities.

In Part II: State of Capabilities (2025 Benchmark), we will shift focus from the organisational layer to the technical layer. We will examine the flagship models of 2025, auditing the current landscape of reasoning, context adherence, and agentic reliability that forms the foundation of the modern AI stack.

Stay tuned for Part II.

References

5 Agentic AI Trends Reshaping Enterprise Automation in Q4 2025 - EvoluteIQ

Top 10 AI Trends to Watch in 2026 - United States Artificial Intelligence Institute

AI in 2025: What We Got Right + Insights for 2026 - SambaNova

Digit Moves Over 100,000 Totes in Commercial Deployment - Agility Robotics

Humanoid robots: Crossing the chasm from concept to commercial reality - McKinsey

13 LLM Adoption Statistics: Critical Data Points for Enterprise AI Implementation in 2025

All You Need to Know About GPT-5 [August 2025 Update] - Wow Labz

AI vs Live Agent Cost: The Complete 2025 Analysis and Comparison

Very well written. So much will continue to change in 2026